We will answer all of your questions, as they impact both your tax and financial situations. Our high standards, service and specialized staff spell the difference between our outstanding performance, and other firms. Today, the company’s global footprint extends to over 35 countries, and it monitors https://www.bookstime.com/articles/invoice-financing over 200 million records per day – particularly in its key markets of India and Singapore. Shift time spent on governance to guidance by replacing repetitive work with leading practices. AI can also be used in many of the below technologies to further streamline progress and mitigate risk.

In the end, the pharmaco managers decided not to bring the outsourced elements home to automate. But they did renegotiate the company’s BPO contract, saving 40 percent or more over the next three years. One of the obvious and most immediate benefits of financial automation is time and cost savings. Through the streamlining of various processes and the minimization of manual interventions, tasks that once took hours can now be completed in mere minutes. This not only increases operational efficiency but also considerably mitigates the risk of human error, therefore enhancing the overall accuracy of financial activities. Finance automation offers several advantages that significantly elevate business operations.

Governance

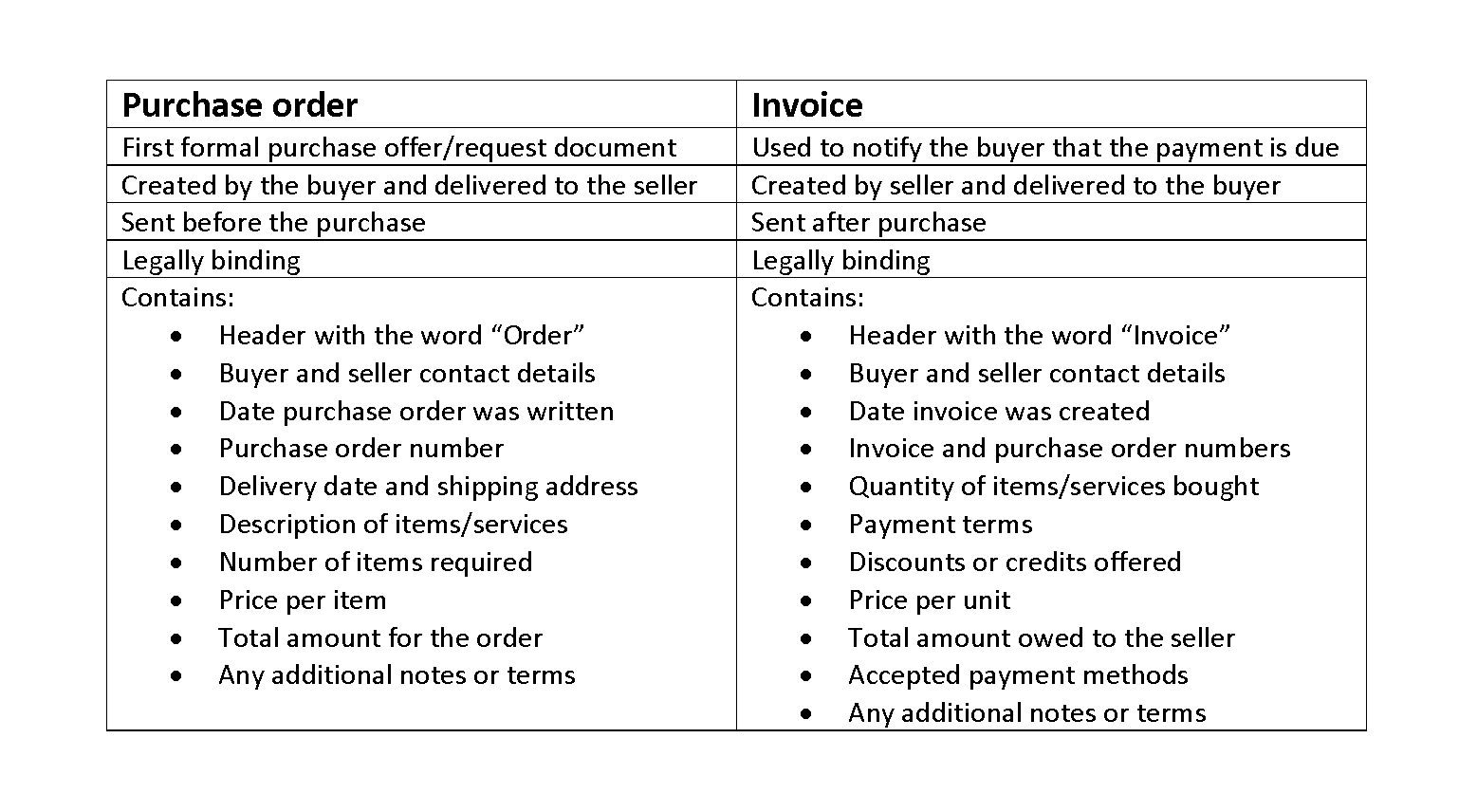

A significant portion of small business owners still manage payroll manually, underscoring the urgency for automation adoption. This shift not only guarantees precision and consistency in payroll but also significantly enhances operational efficiency within businesses. Automating spend management and managing procurement enhances efficiency in managing expenses and purchase orders, eliminating the cumbersome use of spreadsheets. Finance automation software modernizes the process by issuing virtual credit cards that integrate seamlessly with accounting systems.

Businesses of all sizes have compliance issues that require close attention, from client and staff management, to bookkeeping, inventory, budgeting and taxation. To help manage these processes, they often turn to a certified public accountant, a technology they can use in-house, or both. Learn more about Automating financial services with robotics and cognitive automation. Although R&CA hinges on technology, the primary focus should be on business outcomes. The most successful organizations are laser-focused on what they are trying to achieve with R&CA, and they have success measures that are explicit and transparent. This clarity makes it easier to align people, resources, and initiatives across the enterprise to achieve the expected benefits.

Does Redwood provide finance and accounting software?

Sales and finance personnel work in different systems, and when data doesn’t flow automatically between these tools, finance and accounting teams manually re-enter data. Refocus your teams on analysis and strategic business partnership by replacing repetitive, spreadsheet-heavy work with leading-practice automation. Centralize data and close activities, automate journal entries and reconciliations, strengthen controls, and enhance visibility. A holistic view of automation capabilities can help organize and galvanize a team to avoid the common robotics and cognitive automation pitfalls and ultimately achieve scale.

Effective treasury management (particularly with the addition of business automation and AI) helps your company maximize liquidity and enhances your financial performance. Empower treasury analysts to identify investment opportunities with greater speed, accuracy, and confidence, and decrease uninvested cash by improving cash-forecast reliability. Digitize reconciliation processes, eliminate errors from workflows, and automate data extraction, freeing up analyst time to focus on more strategic work. Finance organizations perform a wide range of activities, from collecting basic data to making complex decisions and counseling business leaders. As a result, the potential for improving performance through automation varies across subfunctions and requires a portfolio of technologies to unlock the full opportunity. Applying the same methodology outlined in the McKinsey Global Institute’s automation research, we found that currently demonstrated technologies can fully automate 42 percent of finance activities and mostly automate a further 19 percent (Exhibit 1).

ON-PREMISE SUPPORT LOGIN

Automate complex journal entries, the extraction of monthly reports, and reduce processing times for disclosure. Software robots perform tasks such as collecting bank statements and entering critical financial data into the A/R system. By introducing AI-powered technology into the process, finance teams ensure customers receive accurate quotes, orders accounting automation are fulfilled correctly, and any issues are resolved seamlessly. Not only will this boost customer satisfaction—it could lead to increased sales and revenue for your organization, too. Find out how to streamline your finance function, reduce costs, and unlock new opportunities for growth — all through a single, unified intelligent automation platform.

- By automating accounts receivable functions, businesses can streamline everything from invoice generation to payment collection.

- Not only will this boost customer satisfaction—it could lead to increased sales and revenue for your organization, too.

- Expanded sales tax liability is a potential minefield for businesses of all sizes, especially those with ecommerce activities, requiring constant tracking and application of changing tax rates across thousands of jurisdictions in the U.S.

- To capture that potential, managers must be willing to reengineer their processes completely.

- Our high standards, service and specialized staff spell the difference between our outstanding performance, and other firms.

- Streamline and automate activities in SAP with task scheduling and execution, activity monitoring, and outcome verification.

Share information through unique auditor roles to reduce paper, storage, T&E, and other unnecessary costs. According to the 2017 Deloitte state of cognitive survey, 76 percent of companies across a wide range of industries believe cognitive technologies will “substantially transform” their companies within three years. However, the survey also shows that scale is essential to capturing benefits from R&CA. Specifically, 49 percent of respondents with 11 or more R&CA deployments reported “substantial benefit” from their programs, compared to only 21 percent of respondents with two or fewer deployments. These bots operate 24/7, are incredibly scalable, and can easily interact with other applications like banking systems to provide more real-time visibility and control. Two accounting leaders explain how they lighten their load through people, processes and systems.