You can make changes to past reconciliations, but be careful. Changes to completed reconciliations can unbalance your accounts and other reconciliations. It also affects the beginning balance of your next reconciliation. When you reach the end of your transactions, the difference between your statement and QuickBooks should be CA $0.00.

- When Biller Genie processes a customer payment, the corresponding QuickBooks invoice is closed automatically.

- This is a time-saving feature that can benefit any business user.

- If your firm uses QuickBooks Online Accountant, you have a special reconciliation tool.

- You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication.

You can use the Direct Connect Option by enrolling for the Direct Connect service which will allow you access to the small business online banking option at bankofamerica.com. This feature allows you to share bills, payments, information, and much more. You can browse a list of past reconciliations and the dates they were finished by selecting Summary. You will see the same list and any changes or automatic adjustments performed by QuickBooks if you select History by Account. On this page, you can print a reconciliation report for any previous reconciliation. While the data import from your various accounts into QuickBooks is likely to be very accurate, it’s not foolproof.

How to reconcile accounts in QuickBooks Online

We’ll dive in to free options and low-cost options and their features, just in case you’re not satisfied. It helps you know the true, up-to-date value of your business. It can also help with account audits and tax preparation by catching errors early.

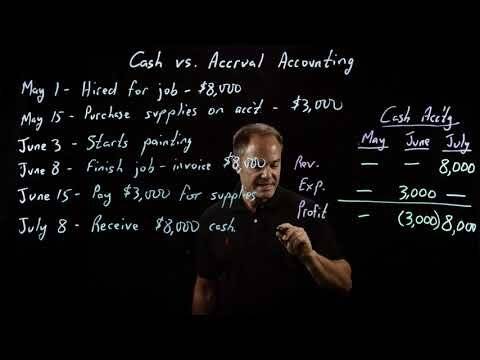

No doubt, the chart of accounts acts as the backbone of accounting and QuickBooks Online adds more life to the monthly culmination of all the financial data records. Of all the tasks you’ll need to perform within QuickBooks, though, one of the most essential is reconciling your accounts. Keeping your accounts up to date is the only way to ensure that you stay within budget and understand exactly how much cash your business has on hand at any given moment. When choosing an account to reconcile, ensure it corresponds with the one on your statement. It’s crucial to verify that the beginning balance in QuickBooks Online matches the one in your statement, and any discrepancies should be investigated and rectified. For bank transactions such as deposits, withdrawals, and fees, make sure each one is recorded; leveraging the QuickBooks bank feed feature can facilitate easier tracking and recording.

Why is reconciling my accounts important?

Once connected, all bills in QuickBooks Online will sync in real-time with Wise. Bill payments are automatically synced, matched, and categorized in QuickBooks. All QuickBooks Online plans include good reporting options, with the Advanced plan offering the most comprehensive reporting options, including key financial metrics such as revenue and cash flow. Reporting options are good in both applications, though only one of the applications offers industry-specific reporting options.

Support options are fairly similar for both QuickBooks Online and QuickBooks Desktop, with the more expensive plans offering better support options. To review your file data on the preview screen, just click on ”next,” which shows your file data. Check your entry of the statement balance, Service Fees, and interest income three times. Make sure that if the service fee and interest revenue are not already in QuickBooks, they are only added following the reconciliation. On QuickBooks Online, you get a detailed overview of your bank account via which you need to know what are your current holdings, how much was spent, and what amounts have been gained. A second Reconcile report is generated for the month, representing the single reconciliation you performed for the sales tax payment.

Frequently Asked Questions

Select the account you wish to reconcile from the Account drop-down menu. Having up-to-date and accurate accounts is important for any business. If the difference isn’t CA $0.00, or you can’t find a transaction that should be in QuickBooks, don’t worry. You can also make small edits if needed right within this window.

- It can also help with account audits and tax preparation by catching errors early.

- If there are dissimilarities between statements that are unanticipated, it’s critical to get to the root of the problem and either unfold the differences or regulate it.

- If you forgot to enter an opening balance in QuickBooks in the past, don’t worry.

- Before you start, you may want to download any attachments tied to the reconciliation.

- Then click the “Print” button in the upper-right corner of the report to print it, if needed.

- To expedite product setup, you can choose to use the default chart of accounts that is included in the application.

Then click the “Apply” button in the drop-down menu to apply the filters you selected. You can remove applied filters by clicking the “X” button to the left of the applied filter’s name or by clicking the “Clear filter / View all” link. If needed, then enter any bank service fees or interest earned into the “Enter the service charge or interest earned, if necessary” section. Enter any bank service fees into the “Service charge” field and then select the date and the account used to track bank service fees from the adjacent “Date” and “Expense account” drop-downs. To enter interest earned, type the amount of interest earned into the “Interest earned” field.

QuickBooks Online vs. QuickBooks Desktop: Reporting options

You must find the ending balance of the previous month and the starting balance of the current month matching. With QuickBooks Online, this balancing of the transactions made would be matching with your bank statements if the reconciliation has been done correctly. If you’re reconciling an account for the first time, review the opening balance. It needs to match the balance of your real-life how to read and understand income statements bank account for the day you decided to start tracking transactions in QuickBooks. To simplify this process, though, you can connect your online bank accounts and credit card accounts to QuickBooks Online. Transactions that post to these accounts are automatically sent to your QBO account as well, resulting in a pre-populated list of purchases and deposits in your QBO transaction register.

QuickBooks Online vs. QuickBooks Desktop: Pricing

Ensure that the Statement Date in QuickBooks Desktop corresponds with your actual bank statement, making adjustments as needed. QuickBooks Desktop will automatically generate a Beginning Balance based on your last reconciliation. In your first reconciliation, ensure that the opening balance in QuickBooks Desktop is in sync with the balance of your real-life bank account as of your chosen start date. After completing an account reconciliation, a reconciliation report becomes available. In the “You reconciled this account” window that appears, you can click the “View reconciliation report” link to view the report. Otherwise, click the “Done” button in this window to close it.

How They Compare: QuickBooks Online vs. QuickBooks Desktop

Since all of your transaction info comes directly from your bank, reconciling should be a breeze. You can see transactions that have come directly from your bank feed, and transactions that you’ve manually added in QuickBooks. QuickBooks Online includes numerous learning and support resources. A variety of short video tutorials are available as well as on-demand webinars and training classes.